Following Indonesia’s $30 billion mining boom, the Philippines is taking a bold step to ban raw ore exports within five years, aiming to boost local processing and increase revenues—but industry groups warn of severe economic consequences.

In a report by Bloomberg, Senate President Francis Escudero was quoted saying that lawmakers are moving swiftly to ratify the bill, with the bicameral committee expected to finalize discussions during Congress’ break. The bill, which Escudero authored, passed the Senate’s third and final reading and could be approved as early as June when sessions resume.

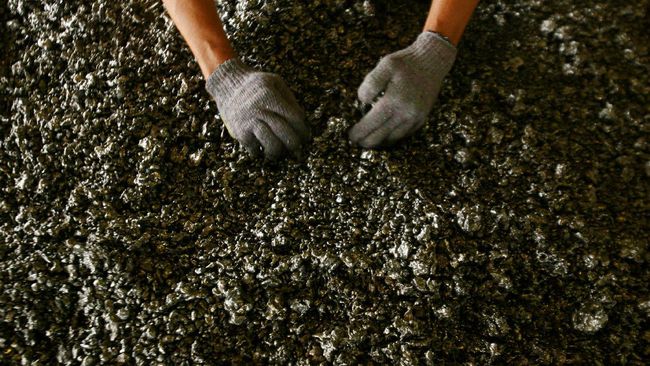

The proposed law seeks to prohibit the export of raw nickel ore and other minerals, compelling mining companies to build local processing plants. Lawmakers argue that this shift will create jobs, attract investments, and increase government revenues—mirroring Indonesia’s strategy, which saw the value of its nickel exports skyrocket from $3 billion to $30 billion within two years after enforcing a similar ban in 2020.

“We are a resource-rich country pretending to be poor,” Escudero said, pointing out that less than 3% of the Philippines’ 9 million hectares of mineral-rich land is currently being mined. The government hopes that by banning ore exports, the country can finally move up the mining value chain.

Indonesia, the world’s largest nickel producer, has demonstrated how restricting ore exports can force international players to invest in domestic processing. After implementing its ban, Chinese companies poured billions into building smelters and refineries in Indonesia, significantly increasing the country’s nickel export value.

The Philippines, the second-largest nickel ore supplier globally, primarily exports to China. Lawmakers believe that by following Indonesia’s lead, the country can capture more value from its natural resources rather than exporting raw materials for minimal profits.

Earlier, however, mining companies and industry groups have already sounded an alarm. The Chamber of Mines of the Philippines and the Philippine Nickel Industry Association argue that the policy will have severe economic repercussions.

“The proposal will cause massive disruptions to existing supply chains; many mining companies have long-term contracts and established relationships with international buyers,” the groups said in a joint statement.

Industry leaders warn that the five-year transition may not be enough time for miners to build processing facilities, which require huge capital investments and stable energy supplies. They fear that if the law is enforced prematurely, smaller mining firms may shut down, leading to job losses and a reduction in government revenues from the sector.

Additionally, concerns have been raised over whether the Philippines has the infrastructure and investment climate to support large-scale mineral processing. Indonesia’s success was largely driven by heavy Chinese investment—a scenario that may not be easily replicated.

Congress is expected to revisit the bill after the break, with the bicameral committee finalizing the details before the anticipated June ratification. If signed into law, mining companies will have five years to comply, a timeline that could determine whether the Philippines successfully follows Indonesia’s trajectory or struggles with industry upheaval.

As the country stands at a crossroads, the question remains: Will the Philippines strike gold by processing its own minerals, or will the move backfire, forcing mine closures and economic downturns?