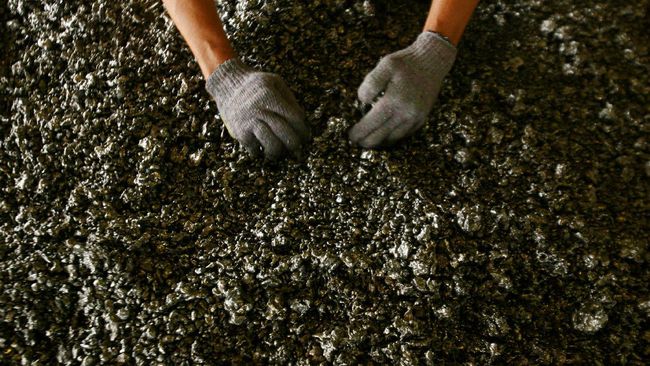

A proposed ban on raw mineral exports, including nickel ore, could cripple the Philippine mining sector, disrupt global supply chains, and drive investors away, industry leaders warned.

The Philippine Nickel Industry Association (PNIA) said the ban would create economic instability by deterring exploration, halting investments, and forcing mining companies to scale down operations.

In a Business World report, the organization added that Indonesia only enforced its export ban after creating the right conditions, such as improving infrastructure, offering tax incentives, and ensuring access to affordable power.

PNIA pointed out that, unlike Indonesia, the Philippines struggles with high production costs, weak policy implementation, and unreliable power supply, making it difficult to establish a competitive mineral processing industry.

The Chamber of Mines of the Philippines (COMP) also warned that the ban could violate long-term contracts, leading to legal disputes and harming the country’s reputation as a reliable supplier.

Earlier, Senate President Francis Joseph G. Escudero filed a bill seeking to prohibit mineral exports from pushing for domestic processing, but mining executives argue that the country lacks the infrastructure and incentives to make local refining viable.

PNIA President and Global Ferronickel Holdings, Inc. CEO Dante R. Bravo said the ban would discourage exploration and development, as companies would see no clear path to profit.

PNIA Board Member and Nickel Asia Corporation CEO Martin Antonio G. Zamora also shared the same sentiments, saying that without major reforms in permit processing and energy costs, the Philippines cannot compete with Indonesia, which successfully implemented a similar ban.

Zamora also noted that mining permits in the Philippines take around 10 years to be approved, pushing investors to more business-friendly countries.

Analysts predict that while global nickel demand will rise by 5% in 2025, the oversupply from Indonesia and technological shifts toward lower-nickel batteries could further depress prices.

PNIA, which accounts for 85% of the country’s nickel output, has operations in Dinagat Islands, Isabela, Palawan, Surigao del Sur, Surigao del Norte, Tawi-Tawi, and Zambales.

Policymakers must weigh the economic risks of an export ban and focus on reforms that make value-added processing viable without crippling the mining sector.